Table of contents

Indonesia is the fourth largest populated country worldwide. Its charm as a real estate investment is evident to all. It has over 17,000 islands and in each and every one of those beautiful spots you could find luxurious villas, high-rise apartment buildings and beachfront plots of land.

As the nation’s economy keeps on developing and its tourism sector grows, and considering the affordable prices of the properties, Indonesia properties for sale make a sound investment proposition for both local and overseas investors.

Though it has some foreign ownership restrictions, Indonesia has increasingly welcomed foreigners through long term leasing and government-sponsored investment schemes. Whether you’re in the market for a retirement house, holiday rental or savvy investment, the Indonesian market has tremendous growth opportunities.

Why Invest in Indonesian Property?

Those looking to add Indonesian properties to their investment portfolio could expect affordable housing and great returns on their investment. Here’s why it’s seen as a strategic location to invest in property:

- Middle class expansion: Over 50 million middle-class consumers create a significant amount of local demand for housing in Indonesia.

- Foreign tourist destination: Over 4 million foreigners visit Bali each year.

- Stable rental income: The rental return from property at popular holiday destinations is 8-12%.

- Economic growth: Indonesia’s GDP increased 5.05% in 2023 (BPS Statistics).

- Infrastructure investment: The government is enhancing airports, toll roads, and seaports.

- Digital nomad hub: Bali, in particular, has become a number one option for remote working.

- Low cost of living: It costs less to maintain rental properties here compared to other countries in Asia.

- Range of properties: From off-plan apartments right through to eco-villas and beach plots.

How are the Property Prices in Indonesia?

It is essential to analyse Indonesian property prices in order to make a sound investment. There are significant price differences between city regions like Jakarta and more remote areas. Proximity to well-known tourist areas like Bali also significantly influences market value. The following chart will put these things into perspective for you:

| Price Factor | Description |

| Average Price (2024–2025) | Around IDR 16 million (approx. $1,000) per square meter in urban areas |

| Price of an 80 m² Apartment | Approx. IDR 1.28 billion (around $80,000) in major cities |

| High-Cost Areas | Jakarta: ~$1,560/m² | Bali: ~$1,375/m² (especially in tourist districts) |

| More Affordable Regions | Yogyakarta & Surabaya: approximately between 625 and 812 US dollars. |

| Impact of Location | Properties near beaches or business hubs tend to be 30–50% more expensive |

| Special Deals for Mid Budgets | Dxboffplan highlights new off-plan projects in up-and-coming suburban areas |

Popular Areas for Indonesian Property Investment

Indonesia offers a vibrant and diverse lifestyle. The vibe you’ll experience here is relaxed and people are welcoming. There are many rich cultural festivals, and you’ll feel right at home with ample connection to nature and community. Here are a range of desirable towns in Indonesian for property investment:

Bali Real Estate Market

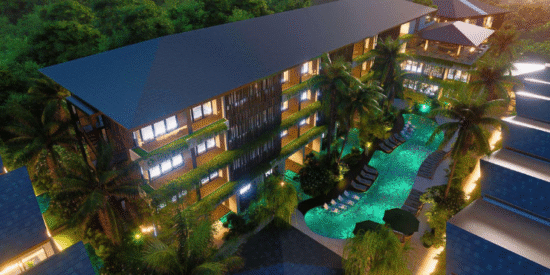

The best known worldwide real estate region in Indonesia. Renowned for tourism and multiculturalism as well as natural splendor, property prices in Bali are on the rise. Here’s what to expect:

- Growing demand from tourists for brief stays

- Locations like Seminyak, Canggu, and Ubud also offer luxury villas

- Foreign-friendly policies and digital nomad visa programmes

Jakarta Property Market

Indonesia’s financial center and capital. Ideally suited for the investors in search of urban office towers and apartments. Here are its investment potential:

- Growing demand for vertical residential spaces

- Multiple business parks and mixed-use facilities

- Investment opportunities in upcoming cities like BSD city and Bekasi

Lombok Real Estate Market

Known as “the next Bali.” Lombok has stunning beaches and untapped landscapes and lower entry charges. Here are why the region in recommended:

- Government-funded tourism development (The Mandalika Project)

- Lower land costs compared to Bali

- Ideal for low-density developments and eco-resorts

Property Market in Batam & Bintan

As they are close to Singapore, they make perfect destinations for foreign investors. Here are the incentives offered:

- Tax incentives in Special Economic Zones

- Strong rental demand from expatriate professionals and tourists

Indonesia’s Law on Foreign Property Ownership

Indonesia doesn’t give foreigners full freehold rights over properties, yet there exist regulatory schemes for the investment in properties:

- Hak Pakai (Right of Use): Allows foreigners to rent a building or a piece of land for 80 years.

- PMA Structure: A foreign company which has rights under Indonesian law to hold freehold titles.

- Leasehold Agreements: Generally 25–30 years, which can

- Nomination Plans (not recommended): Hazardous and not legally secure.

This is why it is necessary to consult our agents on Dxboffplan and involve trustworthy intermediaries while buying a piece of Indonesian property.

Critical Perspectives on Indonesian Property Ownership

Indonesia has the largest economy in Southeast Asia and has a very active real estate market in which foreigners can invest. As we mentioned, foreigners cannot own freehold land outright but can invest under a leasing or leasehold arrangement or through a foreign-owned entity (PT PMA). Prime destinations like Bali and Jakarta remain in the spotlight due to the huge rental demand and returns on investments.

Bali villas remain a top pick with rental returns of as high as 12% per year. Urban life in Jakarta remains the backbone of steady sales of apartments as well. The government encourages real estate investment and upgrading the infrastructure, notably in locations where land prices are significantly lower than those found in Bali.

Legal Procedures for Buying Property in Indonesia

In Dxboffplan, we will be there for you in every step of Purchasing Property in Indonesia. Here is what you need to prepare for:

- Perform extensive due diligence: The land must be clear of title and zoned for the intended purpose.

- Check property type: it must be Hak Pakai (Right to Use) and Hak Guna Bangunan (Right to Build).

- Refrain from nominee ownership: It can be legally challenged.

- Review property deeds: The property papers (title, building permits, zoning approval) should be checked and verified first when signing off on the official agreement of sale (PPJB) to avoid legal issues in the future.

- Get familiar with taxation requirements: Note the acquisition tax, VAT, and rental income tax.

- Final registration at BPN (National Land Agency): you’ll be provided with a certificate of right to use or construct, finalizing the purchase in a legal manner.

After that you can explore property rental management and check out income from rentals and maintenance if you’re not in Indonesia.

Documents You’ll Need to Buy Property in Indonesia

Here is the range of documentations you’ll need in order to complete a real estate transaction in Indonesia:

- Valid passport

- KITAS or KITAP (temporary or permanent stay permit)

- Tax Registration Number (NPWP)

- Sale and Purchase Agreement (PPJB)

- Hak Pakai (Right to Use) or Hak Guna Bangunan (Right to Build) agreement

- Land certificate of the property

- Building permit (IMB)

- Zoning status confirmation

- Official registration with the National Land Agency (BPN) through a certified notary

Last Words

Indonesia’s real estate market is one of Asia’s most dynamic and growing markets. Given the right set of regulations, due diligence, and professional advice, Indonesia properties for sale offer a profitable as well as lifestyle-enhancing investment option. From Balinese villas through Jakarta development properties and virgin land in Lombok, they offer a golden opportunity for every investor in Indonesia. Whether you’re a long-term capital appreciation investor or a vacation rental investor, Indonesia deserves a second glance on your investment radar.

Select City

Top

Projects

frequently asked questions

Foreigners can lease property but cannot directly own freehold land in Indonesia.

Bali is the most popular area due to its tourism, lifestyle, and investment potential.

There are three property rights including Hak Milik (Full Ownership) – Not allowed for foreigners, Hak Pakai (Right to Use) and Hak Guna Bangunan (Right to Build). These are allowed for foreigners, normally for 30 years with extensions possible for up to 80 years.