Dubai vs. Tehran: A Comparison of Property Prices, Laws & Residency Programs

Investment in real estate in today’s era is not just a shrewd financial decision but a long-term method of creating and securing wealth. The economic uncertainty and rapidly evolving world markets put careful planning and market research right at the very top of every investor’s lists. Dubai and Tehran are two glittering cities on the Middle Eastern real estate map—both good investments on their own merits with advantageous aspects for local and global investors alike.

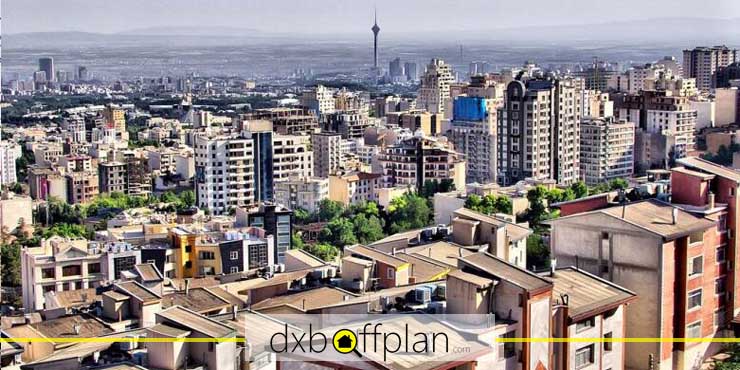

Being the Iran capital city offers a cosmopolitan lifestyle, a vibrant market and relatively competitive real estate costs, drawing local and even foreign investors. Dubai’s modern-day facilities and well-defined regulations also draw investors who look for less risky investments.

This article by Dxboffplan offers a balanced and precise comparison between investment in Dubai or Tehran real estate market. We present some of the key aspects like ownership regulations, taxation regimes, advantages and disadvantages, and return on investment. If you’re thinking of venturing out in the real estate market or deciding on your next destination between the two cities, we’ve got you covered.

Detailed Comparison: Purchasing a Property in Dubai and Tehran

In deciding the optimal place for investment in Dubai or Tehran, a comparison between two big cities can play an important role in your ultimate decision. Here is a close look:

- Ownership Law: Foreigners cannot buy a house in Tehran since they usually require Iranian partners or a special permit. Dubai offers foreigners 100% freehold rights in certain areas on the promise of full legal security.

- Taxes: Tehran has various taxable properties including rental income and capital gains and transfer tax depending on the type and area of the property. Dubai has minimal taxation on properties—only a 4% fee on transfer and not rental or yearly taxation.

- Rental income: Tehran’s rental market also faces high inflation, and therefore returns can fluctuate. Dubai offers stable, tax-free, dollar-denominated rental income, ideal for anyone seeking safe passive income.

- Legal Openness: Property transactions in Dubai are speedy and easy, especially for foreigners. Legal procedures in Tehran take a long time and are cumbersome, especially for foreigners.

Comparison of Property Prices in Dubai and Tehran

According to the latest data, property prices in Dubai are far higher than those in Tehran. For example, the price per square meter of a flat in downtown Dubai is, on average, 2.5 times higher than in downtown Tehran. However, after factoring in the availability of higher wages, more favorable interest rates, along with a safer real estate market, Dubai remains the better investment option for foreign investors. Tehran’s lower prices, however, present great opportunities for domestic purchasers. Here’s a closer look of Monthly Rent Comparison when it comes to investment in Dubai or Tehran:

Monthly Rent Comparison (Apartments)

| Apartment Type | Tehran (USD / AED) | Dubai (USD / AED) |

| 1-bedroom (City Center) | $491.89 / AED 1,806.70 | $2,383.28 / AED 8,753.80 |

| 1-bedroom (Outside Center) | $348.70 / AED 1,280.79 | $1,532.88 / AED 5,630.25 |

| 3-bedroom (City Center) | $1,083.09 / AED 3,978.19 | $4,568.10 / AED 16,778.64 |

| 3-bedroom (Outside Center) | $687.24 / AED 2,524.23 | $3,003.22 / AED 11,030.81 |

Property Price Comparison (Per Square Meter)

| Location | Tehran (USD / AED) | Dubai (USD / AED) |

| City Center | $1,847.12 / AED 6,784.47 | $6,937.17 / AED 25,480.22 |

| Outside Center | $1,263.57 / AED 4,641.08 | $3,737.26 / AED 13,726.94 |

As seen above, rental and property prices in Dubai are significantly higher than in Tehran. That shows Dubai’s global position and higher demand.

Laws of Property Purchase in Tehran and Dubai

It is crucial to know the legal system in every city to minimize risk and safeguard your real estate investment. For instance, foreigners do not enjoy the same right in Tehran and can buy buildings and land in specific regions only after receiving official government approval from organizations like the Ministry of Interior and the Registry Organization. The permission process is slow and cumbersome. The process of registration and change of ownership takes weeks or even months and sometimes includes legal complexities. Foreigners purchasing in Tehran are mainly concerned about:

- Requirement of formal government approval

- Few official places where purchasing is allowed

- Labor-intensive and time-consuming administrative procedures

- Absence of a fully electronic registration system

By contrast, Dubai has a transparent and modern system of law. Foreign investors may acquire property rights of 100% and own freeholds without having a local partner in specially created Freehold Zones. The titles are completely computerized and may be bought and transferred in a matter of days through the internet by the purchaser. The level of certainty of law and quickness of the system make Dubai highly desirable for foreign investors.

Booming Growth of Dubai Real Estate Market

During the past two decades, Dubai’s realty sector has emerged as one of the world’s most exciting and esteemed ones. Breathtaking buildings, man-made islands, and cosmopolitan neighborhoods line Dubai have reshaped the region’s architecture and established Dubai as a worldwide investment center. All this has been possible thanks to careful planning, liberal economic policies, and the strong support of the government. Some of the key drivers of development that may influence your decision on investment in Dubai or Tehran include:

Diversified Economy

Shifting away from an economy based on oil, Dubai’s Economy Continues to Soar, turning toward tourism, trade, and financial services. This has fueled residential, office, and commercial market demand. Growth in tourist traffic and influx of skilled labor and multinational corporations ensures steady real estate demand.

Iconic Developments

Iconic projects like Burj Khalifa, Palm Jumeirah, and Dubai Marina established global standards. These developments offer lifestyle and investment options with unmatched amenities and returns for locals and tourists alike. Dubai’s cutting-edge architecture formed a dynamic and future-proof market.

Attracting Foreign Investors

Dubai’s open policies grant foreigners 100% Freehold ownership rights, exemption from income tax on rental income, exemption from annual property tax, and exemption from capital gains tax. These advantages make Dubai a top real estate investment hub for foreign investors in the world’s rankings.

Government support and Upcoming Initiatives

Expo 2020 and smart city projects drive growth. New business areas, luxury residential and tourism development perpetually expand the market. The government offers advanced infrastructure, ease of buying processes and procedures, and transparent legislative protections assurring investor trust.

Iranian Real Estate Market

Despite economic sanctions and internal challenges, Iran’s real estate market has seen considerable growth driven largely by domestic demand rather than foreign investment. The drivers of this growth are:

Rapid Urbanization

Population growth in cities like Tehran, Mashhad, Isfahan and Shiraz creates demands for housing in low and middle-income groups. Urban and suburban housing stocks become stressed as a result of it.

Government Schemes and Economic Reforms

Schemes such as the Maskan Mehr project were meant to supply the low-income classes with housing at affordable prices, in spite of technical and implementation-based criticisms. Later schemes such as Maskan Melli follow the same principle, indicating the government’s emphasis on social equity in housing.

Domestic Demand

Unlike most of the countries in the area, Iran’s real estate market has a larger base of domestic demand rather than foreigners as investors. Iranian property serves not only as a means of housing but also as a conventional and stable vehicle for accumulating wealth. The investment culture maintains the market relatively well supplied even in hard times.

Challenges and Consequences of Sanctions

The sanctions on the global level create a serious challenge, deterring foreign investment, increasing inflation, and reducing access to global financing. This results in excessive price volatility, decreased purchasing power, and the absence of secondary markets internationally, thus increasing the risk of Iranian real estate investment.

Advantages of Investment in Iran’s Real Estate Market

Despite challenges, Iran’s real estate market remains the most stable investment path for Iranian households, especially in times of economic uncertainty:

- Inflation protection: Real estate generally appreciates at the same rate as inflation and preserves assets even when currencies fluctuate.

- Solid demand: Large cities like Tehran enjoy strong market demand, which stimulates and facilitates sales.

- Dual income streams: Regular rental income and subsequent capital appreciation provide ensured returns.

- Diversity: Geographic and economic diversity in Tehran offer options for a variety of budgets and tastes.

- Protective rights for the owners: Legal setups like the system of tenant-landlord agreement clearly define rights and secure owners in disputes.

- Cultural preference for homeownership: Strong homeownership preference in Iran guarantees continuous demand even in unfavorable conditions.

Why Dubai is an Attractive Place for Iranian Investors

Faced with economic uncertainty locally and regulatory restrictions, Iranian investors seek diversification abroad. Dubai offers unmatched opportunities:

- Tax exemptions: No tax on rental income or buying/selling of properties, yielding greater net returns.

- Long-term political and economic stability: Good governance assures investment security.

- Strategic location and global accessibility: Being close to Iran and offering direct flights, Dubai is a global gateway.

- Modern-day green projects: Clean energy and intelligent designs move center stage in keeping with worldwide trends.

- Residency options: Property purchase can offer UAE residency by investment, ideal for those seeking secure and modern ways of life.

Final Words

Both investment in Dubai or Tehran has its own characteristics and pros and cons. Depending on what the investor’s goal is, their investment amount, risk level and lifestyle will determine whether they’ll invest in either or not. The real estate market of Tehran has domestic demand in the lead and has benefits of lower prices, diversity in available projects and a highly strong sense of ownership culture.

The Iranian market remains a traditional but functioning means of gaining and expanding wealth. Dubai has benefits like full ownership for foreigners, economic stability, tax exemption, modernization and having the right of acquiring long term resident status and creating a secure and prestigious environment for international investors. Should you be considering long term investment, foreign exchange earnings, or living in a place with global standards, Dubai would be the preferred option. If, however, local investment coupled with full awareness of the local market and regulations is what you desire, Tehran can be an alternative option as well.

frequently asked questions

Yes. Iranian citizens can buy and own properties in Dubai's freehold areas outright.

There isn't any rental income in Dubai liable for taxation, which would certainly be the most attractive benefit of investment in Dubai.

For short term investment, Tehran offers quicker buying and selling options in the unstable domestic market while Dubai suits medium and longer term investment better.