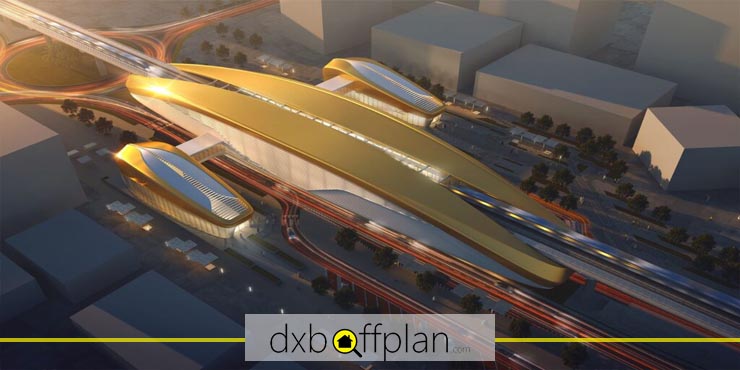

Impact of Dubai Metro Blue Line on the Real Estate Market

The city’s real estate market has changed since Dubai Metro’s Blue Line was introduced. Previously unappealing neighborhoods, like Academic City, Mirdif and Dubai Silicon Oasis, are now popular places to rent and invest. According to real estate experts, this new infrastructure will improve these neighborhoods’ accessibility, lifestyle amenities and long-term capital growth prospects.

Why Have Mirdif, Silicon Oasis and Academic City Attracted Attention?

The extension of the real estate market beyond the traditional central areas of Dubai has been made possible by the Blue Line, which connects the east and west of the city. According to A1 Properties, demand and transactions in these districts skyrocketed in Q2 2025, especially from middle-class and first-time investors.

The main reasons why people are interested in these fields are as follows:

- Easy access to downtown and business districts by transit

- Entry fees are less expensive than in coastal or central areas, and the infrastructure for family-friendly businesses and schools is growing.

Increasing Real Estate Deals and Prices in 2025

Real estate sales in Dubai reached over AED 120 billion in the first quarter of 2025, up 18% from the year before.

- The average annual increase in housing prices is 5.6%

- Apartments: 4.2% increase

- Due to a shortage in established communities, villa prices increased 7.9%

Off-plan projects with metro access have piqued the interest of investors the most, particularly those with adjustable payment schedules.

Growing Rental Market: Silicon Oasis to JVC

Due to mortgage rates ranging from 5.25% to 5.75%, many UAE residents are opting to rent rather than buy. This trend has led to higher rental yields in communities such as Silicon Oasis, JVC, Al Furjan and Dubai South.

- One-bedroom apartments in well-known neighborhoods typically cost between AED 80,000 and AED 82,500 per year

- Apartments with two bedrooms: up to AED 125,000

Rental inflation is expected to continue through 2026, especially in places with easy access to major job centers and metro connectivity.

Foreign Investors and Their Impact on Dubai Transactions

In Q2 2025, over 58% of real estate transactions involved foreign investors, mostly from China, Russia, the UK, and India. They see Dubai as a hedge against inflation and exchange rate swings. However, there aren’t many mid-range apartments available because most of the new supply is concentrated in luxury or branded buildings, which will keep prices high through 2025 and 2026.

Outlook for 2026: Steady Price Growth and Strong Rental Yields

By the middle of 2026, real estate prices in Dubai are expected to increase by 3.5% to 5.2%. Areas that benefit from the Blue Line are expected to outperform the market as a whole in terms of resale value and rental returns. Neighborhoods like JVC, Arjan, Al Furjan and Academic City are likely to see the most activity due to their affordable prices, ongoing construction projects, and close proximity to employment centers.

Conclusion

The Dubai Metro Blue Line has not only transformed the city’s transit system but also played a significant role in the growth of real estate in less well-known areas. Due to a combination of increased accessibility, high foreign demand and a limited supply of mid-income housing, these areas are anticipated to offer significant opportunities for investors and tenants in the years to come.

Source: https://gulfnews.com